DCPA NEWS CENTER

Enjoy the best stories and perspectives from the theatre world today.

Enjoy the best stories and perspectives from the theatre world today.

The Lehman Trilogy, the Tony Award-winning play by Italian playwright Stefano Massini, is a wholly American tale. A German-Jewish immigrant arrives in America, opens a dry goods store in Alabama, and by 1850 has brought along his two brothers in the founding of a trading firm that will become the fourth-largest investment bank in the United States. Its storied history and power were brought low in 2008 with a collapse triggered by investing in subprime mortgages and lighting the fuse on a global recession.

The Lehman story isn’t a lonely one; financial scandals have littered U.S. economic history in the 21st century. Here are a few of Lehman’s compatriots in financial ruin:

Sam Bankman-Fried

Sam Bankman-Fried was a wunderkind…until he wasn’t. By 27, he had founded the cryptocurrency exchange FTX. At 30, he was arrested and extradited from the Bahamas. By 32 – in late March of this year – he had been sentenced to 25 years in prison and ordered to pay $11.02 billion in asset forfeiture as restitution for defrauding both his customers and his investors. Bankman-Fried fell quickly, from No. 41 on the Forbes 400 to mounting evidence of fraud in 2022, leading investors to withdraw their money and the company to collapse. He was found guilty of wire fraud, commodities fraud, securities fraud, money laundering and campaign finance violations.

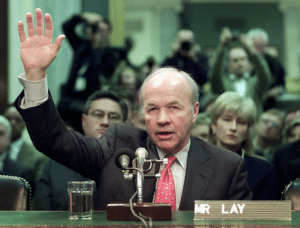

Kenneth Lay. Photo by AFP via Getty

Once the sixth-largest energy company in the world, with branches in commodities and service, Houston-based Enron was brought down by an accounting scandal that had concealed billions in debt resulting from failed projects. The revelation brought down not only Enron, but Arthur Andersen, one of the Big Five accounting firms in the United States. In 2000, the company’s shares were worth $90.75 apiece; a year later, they were worth less than $1, prompting a $40 billion lawsuit by shareholders. With more than $60 billion in assets, the company’s bankruptcy was the largest in U.S. history – for one year, until WorldCom failed even bigger. Multiple executives went to prison as a result of the scandal, but not the company’s founder, Kenneth Lay, who died of a heart attack before being sentenced.

Elizabeth Holmes

At its height, Theranos was valued at almost $10 billion as a result of a technology it promised could streamline blood tests so that only a finger prick was required. Elizabeth Holmes founded the company at age 19, and by 2015 had been named by Forbes as the country’s youngest female billionaire. The claims fell apart after scientists and Wall Street Journal reporter John Carreyrou began investigating. Soon after, the company was being pursued in court not only by investors, but also by the SEC and the Centers for Medicare and Medicaid Services. The company dissolved in 2018; in 2022, Holmes was sentenced to 11 years in prison. Former Theranos president Sunny Balwani was also found guilty of fraud and sentenced to nearly 13 years.

Sometimes, the scandal is not in the punishment, but the reward. American International Group today operates in over 80 countries. In 2005, it became wrapped up in fraud and accounting scandals resulting in a $1.6 billion fine as a result of a NY State Attorney General Investigation. The company rebounded by getting involved in subprime mortgages, lending to high-risk borrowers and not reinsuring those loans. The mortgage crisis that resulted was a major cause of the 2008 global financial crisis. AIG became one of the beneficiaries of the “too big to fail” philosophy, receiving a bailout of $180 billion from the U.S. government. Within less than a year, the company was paying more than $165 million in executive bonuses and incurring the wrath of both Democratic and Republican politicians, including then-President Barack Obama.

Sometimes, the scandal is not in the punishment, but the reward. American International Group today operates in over 80 countries. In 2005, it became wrapped up in fraud and accounting scandals resulting in a $1.6 billion fine as a result of a NY State Attorney General Investigation. The company rebounded by getting involved in subprime mortgages, lending to high-risk borrowers and not reinsuring those loans. The mortgage crisis that resulted was a major cause of the 2008 global financial crisis. AIG became one of the beneficiaries of the “too big to fail” philosophy, receiving a bailout of $180 billion from the U.S. government. Within less than a year, the company was paying more than $165 million in executive bonuses and incurring the wrath of both Democratic and Republican politicians, including then-President Barack Obama.

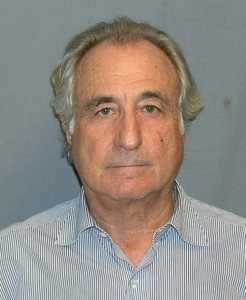

Bernie Madoff

Bernie Madoff’s scandal was impressive not just for its size, but for the limited scope of punishment. Madoff, once the chairman of NASDAQ, constructed an asset management firm that was basically an enormous Ponzi scheme, resulting in the bilking of $65 billion from his investors, which included individuals and several philanthropic organizations. In 2009, Madoff pled guilty to 11 federal felony counts; he died in prison in 2021 at the age of 82. Madoff’s schemes hit philanthropies particularly hard; among others, the $1 billion Picower Foundation, the $198 million Chais Family Foundation, and the $240 million Betty and Norman F. Levy Foundation all collapsed as a result of the fraud.